All information on taxes in Switzerland and related tax consultancy services can be found on this page in the overview.

Tax advice should be correct, timely and affordable. At Simpletax, this is achieved through fixed and target prices, which, in contrast to pure work on a time and material basis, leads to a faster and cheaper result.

Tax consultancy services

Issues in tax consulting include completeness and correctness, optimization of income and expenses, as well as the tax area of pensions.

Costs for tax advice

All services are summarized in our price list for tax and financial services.

Structure of the tax return

Income tax

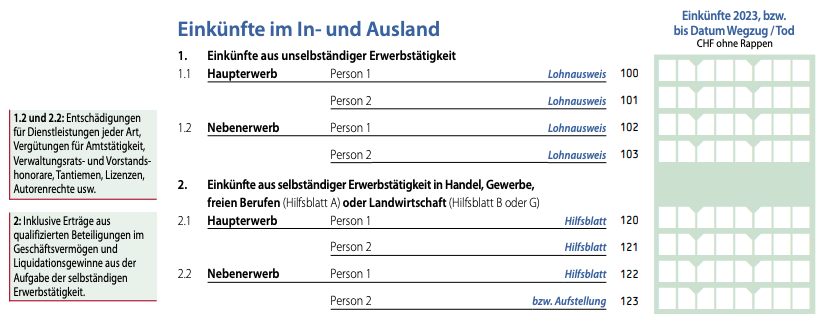

Wages and sideline

For non-self-employed persons, these items are the mainstays on the income side. The net wages are taken from the employer’s salary statement and stated, or a receipt should be enclosed for secondary employment and income without AHV/AL deduction.

Quelle: Wegleitung Steuererklärung Zürich.

Quelle: Wegleitung Steuererklärung Zürich.

Income from self-employment

In a household with 2 people, a combination of wage earners and self-employed persons can also arise.

Imputed rental value

The imputed rental value is regarded as income based on the use of the owner-occupied home. The maintenance of the property can be deducted from this, either as a lump sum or according to a list that may also include value-preserving renovations.

Other values

Depending on their origin, cryptos can also be classified as income in special cases.

Property tax

List of securities

The list of securities is a separate page of the tax return, which should include all bank accounts and securities accounts with financial assets. This can be done easily with an eTax statement.

The securities register also lists investment income with and without withholding tax. These then count as income. It is important to inform the tax office of your bank details for the repayment of withholding tax.

Properties and property register

If you own real estate that is rented out, the property register must be completed with the tax values for assets, rental income and deductions.

If you have your tax return completed with Simpletax , individual properties are charged as an additional service.

Cryptocurrencies

Wealth tax always includes cryptocurrencies or tokens, such as Bitcoin or Ether (Ethereum). These are to be listed as normal in the list of assets and as at the cut-off date of 31.12. to declare and pay tax.

Withholding tax

Withholding tax is levied on employees from abroad. It is set at cantonal level and, above all, is also sector-specific. Persons taxed at source can voluntarily complete a tax return once their income reaches a certain level.

You can also find tips in English on this page.

Property gains tax

The treatment of property gains in the larger cantons is explained in more detail on this page with calculation examples

Property tax

Property tax is only levied in a few cantons.

Transfer tax

The transfer tax has been abolished in many cantons as it is not significant in comparison to the property gains tax.

Time of taxation

The tax return during the year in the same calendar year

In principle, the tax return must be completed for the previous year. In exceptional cases, however, the current year must be declared, e.g. the 2024 tax return must be completed in calendar year 2024.

This applies if the tax liability is terminated, i.e.

-

-

- in the event of the death of the taxable person by the descendants or heirs,

- when moving abroad,

- if you give up your secondary tax domicile in the canton, for example if you sell a property during the year.

-